The shipping industry was seriously affected in 2022 and will continue to be impacted in the new year by high inflation rates and the War on Ukraine. New year messages, as a cliché, are formed by powerful sentences that explain the change and wish for the better. However, the year 2022 was so turbulent that hopes and predictions have quite a meaning.

The containership market is making its way to a dynamic year. Certainly, numerous developments are expected. Let’s look at some of the prominent ones.

FREIGHT RATES

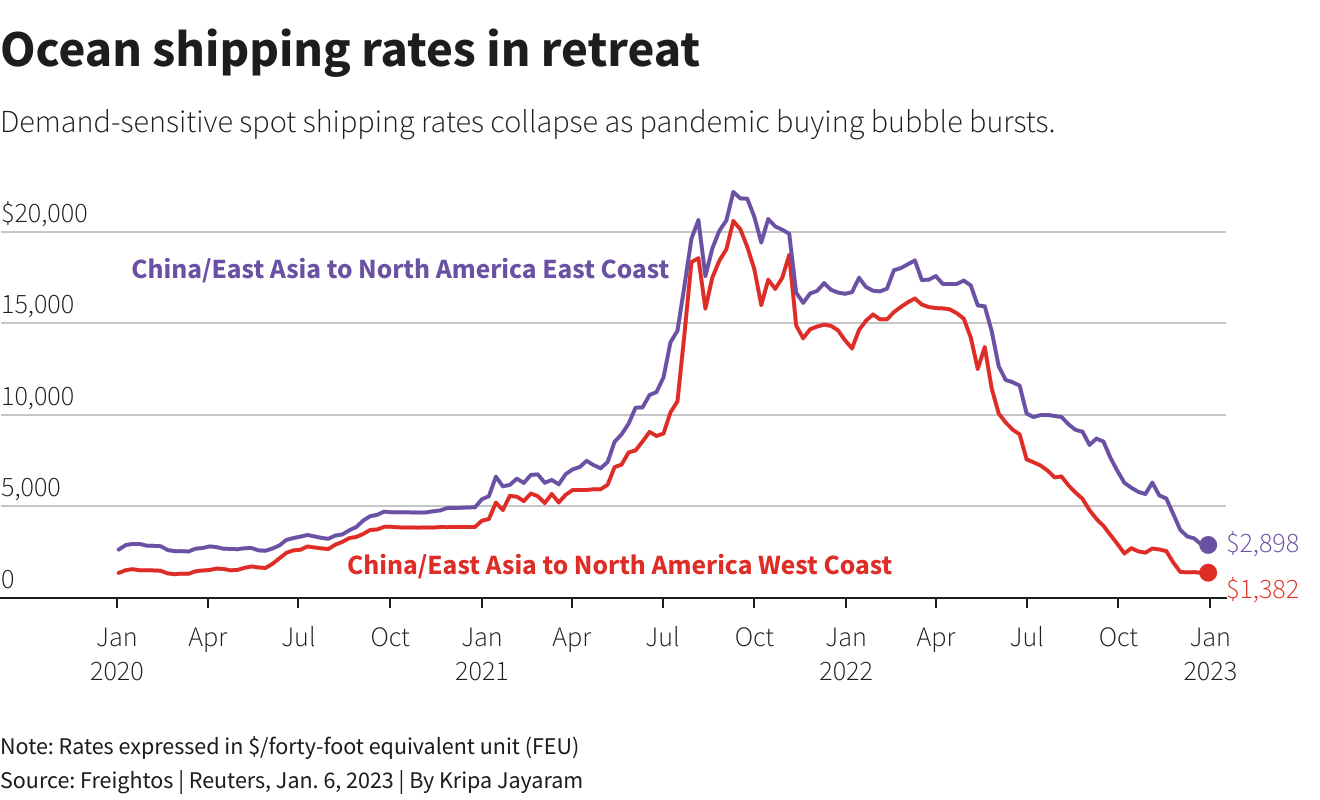

Beginning in the second half of 2020, the containership market saw a time of exorbitant rates and profitability; nevertheless, since the beginning of 2022, container freight rates have been dropping.

Consumer demand has been severely affected by the bleak economic forecast and rising inflation, which has reduced trade volumes while increasing container transportation capacity. Despite the massive service cuts and blanking of sailings undertaken by liner firms, spot freight rates have not been capable of remaining above ‘normal’ levels for long.

Regardless of that, this is a positive thing both for businesses and consumers, liner companies are aware that their peak revenues have long since passed. Major international shipping companies announced record revenues earlier in 2022, however, the sector acknowledged that it does not anticipate witnessing comparable amounts in its existence. The markets have noticed that through 2022, the value of a basket of publicly traded containership operators has roughly decreased by half.

IDLED CARGO SHIPS

Due to a decline in demand on the main east-west routes, AP Moller-Maersk has idled more container ships than any other carrier. According to Alphaliner, of the 122 commercially idled cargo ships, the Danish carrier accounts for close to one-fourth of them. The total numbers cover 29 Maersk-owned or chartered ships with a combined tonnage of 281,400 TEU.

The carrier is followed by MSC Mediterranean Shipping Company, a 2M partner, with 13 commercially idled ships totalling 119,000 TEU. Other significant carriers, however, have not imitated this and usually have only a few of their ships idle. Some of those ships are merely experiencing lengthy waits for their next mission, Alphaliner continued.

As a consequence, Maersk is responsible for 17 of the 35 ships larger than 7,500 TEU that have been commercially idled, according to Alphaliner. Based on the statement, there are 122 ships totalling 721,300 TEU in the commercially inactive container fleet. The number increases to 300 cargo ships when you include the ships that are being repaired or having their classes renewed. Together, they account for almost 1.57 million TEU or 6% of the entire cellular network. Due to a decline in economically idle and dry-docked vessel capacity, the inactive box ship fleet diminished.

EXTRA CONTAINER SHIPS

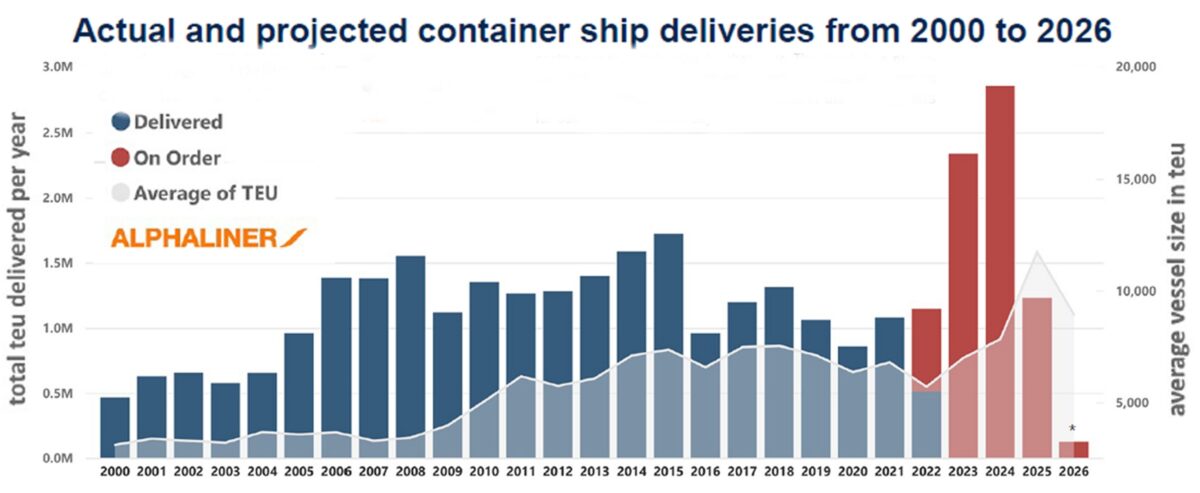

Next year, a growing number of brand-new container ships will be delivered, causing a supply surplus. Pressure on freight prices will increase in 2025 as a result of the capacity being 30% higher than prior to the pandemic. In a recent survey of the container business, British investment bank Barclays reached the forecast.

2021–2022 marked the most prosperous two years in shipping history for the container business. Owners booked more new container ship orders than ever before, as if on cue. Even now, as freight costs fall, they keep placing additional orders.

According to the Alphaliner study, the majority of tonnage on order will be delivered in the next two years: 2.34 million TEUs in 2023 and 2.83 million TEUs in 2024, as opposed to roughly 1.1 million TEUs in both 2021 and 2022.

ULTRA-LARGE CONTAINER SHIP DELIVERIES

This February, Orient Overseas Container Line (OOCL), headquartered in Hong Kong, has welcomed its first new ‘megaship’ with the naming ceremony of the OOCL Spain, the first in a series of six 24,188 TEU capacity container ships on order for the company. The first of six ultra-large container ships were ordered by OOCL in 2020.

The OOCL Spain is one of the world’s largest containerships, with a carrying capacity of 24,188 TEUs, a total length of 399.99 meters, and a width of 61.3 meters, surpassing Evergreen’s 24,004 TEU A-class vessels but falling short of MSC Mediterranean Shipping Company’s MSC Irina and MSC Loreto, which have a reported capacity of 24,346 TEU.

TANKER MARKET

The tanker industry has finally taken off after a couple of challenging years. A number of new long routes have replaced shorter ones, which has changed trade patterns as a result of restrictions on Russian exports and increased tonne-miles demand. Time-charter rates for product tankers are at their highest point since the good old days of 2008.

The tanker order book scenario is going promising for tanker owners. Almost no berths are available for the foreseeable future because the order book as a percentage of the fleet is at an all-time low and shipyards have large backlogs of containerships and LNG carriers to build. Given this backdrop, the market is aware that, assuming a demand collapse, an extended upcycle is in store. In 2022, the value of a basket of publicly traded crude tanker owners would have doubled, whereas the value of publicly traded product tanker firms has tripled.

According to shipowner organization Bimco, product tanker demand in 2024 will increase by up to 8% over 2022 levels due to new environmental rules encouraging slow steaming and average sailing distances rising by up to 4% due to the European ban.

LNG MARKET

The invasion of Ukraine has propelled energy supplies to the top of the priority list. In the near future, the liquified natural gas market is expected to grow and vary.

LNG carrier spot costs have soared to almost $500,000 per day, while time-charter rates have surpassed $200,000 per day, establishing a new record. Although the cost of a brand-new vessel is now exceeding $250 million, orders are all still coming in, and there are currently more than 300 vessels on the order book.

EFFECTS OF WAR

Shipping has been significantly impacted by Russia’s invasion of Ukraine started a year ago. The disruption in the oil and natural gas sector has been severe, according to shipbroker Xclusiv Shipbrokers’ most recent weekly report in March 2023. Russia, the second-largest oil exporter in the world, no longer has Europe.

The preponderance of Russia’s oil infrastructure was focused on moving oil west. Despite having an insufficient infrastructure to transfer large amounts, European sanctions have prompted Russia to look eastward for a new oil consumer base. More tankers were wanted in the Baltic and Black Sea as a result, in addition to the lengthier voyages to the East but also for ship-to-ship transfers. All this was going on, Europe also had a requirement for seaborne oil trade and was compelled to look for other oil sources in order to replace pipeline oil supplies with seaborne loads. As a result, shipping tonne-miles have increased, and vessel supply has dropped while vessel demand has increased.

Xclusiv also reports that “the invasion of Ukraine also lifted oil prices, with Brent Oil Futures surging 35% higher within the first 10 days of the battle and remaining at ranges between USD 95 and USD 118 per barrel for almost 5 months, before starting to de-escalate towards lower levels. Russia announced a reduction in oil production of 500,000 barrels per day on February 5, 2023, the day oil product sanctions began. According to traders and analysts, the production reduction was essential because the majority of Russian oil goods must travel outside of Europe to regions like Africa, Latin America, and East Asia in order to find customers willing to switch from expensive European suppliers to inexpensive Russian ones.

Due to maintenance issues, Russia gradually stopped exporting natural gas through the Nord Stream pipeline, prompting the EU to seek substitute suppliers and lowering Russia’s market position in its gas market from around 50% to under 10%. The European quick transition to LNG has had a favourable impact on the market for LNG carriers, driving up freight rates and vessel prices, as well as the price of LNG commodities.

Also, new trading patterns indicate that product tanker owners trading in sanctioned Russian oil will benefit tremendously. According to data analyst Vortexa, the ban imposed by European countries on Russian imports on 5 February has resulted in diesel cargoes on MR tankers heading to markets further away in West Africa, South America, and South East Asia.

Having tanker fleet growth limited for at least two years, long-haul trades have raised pressure on MR tonnage in the worldwide market. Expected growth in US exports and increased demand may push MR rates higher in the coming months.

After reaching 15-year highs, the Baltic Exchange’s clean tanker index fell to its lowest position in a year when the European import ban went into effect. It has since recovered to October levels, with product tanker owners expecting a sustained period of high earnings.

RECYCLING INITIATIVES

Observers in the shipping and recycling industries have been cautious for months about an impending mass scrapping of container ships as operators right-size their fleets to suit a shrinking freight market. However, clean-up is still not occurring yet.

Container ship recycling sales have begun to take place, but aside from a mass selling of ten ships by Taiwanese owner Wan Hai Lines in January, the pace has been slowing down, with only one or two ships sold for recycling each week since the beginning of 2023.

Although freight rates have fallen considerably, container chartering brokers think that they are still profitable. “Rates will have to fall below operating costs before we see a wider shift toward scrapping,” a Singapore-based container chartering broker predicted. The strong purchasing interest for smaller container ships out of China, Indonesia, and the Philippines, according to Rohit Goyanka, head of Singapore-based Star Asia Shipbroking, additionally eliminated potential candidates from the recycling market.

As of March 2023, recycling sources informed TradeWinds that only two container ships are currently being circulated in the recycling market. AP Moller-Maersk is said to be scouting the market for an unnamed ship, while Wan Hai Lines has welcomed bids for the 1,501-TEU Wan Hai 282. which was built in 1998.