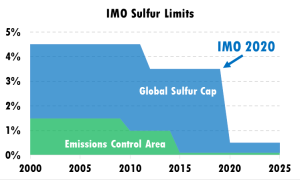

In April 2018, IMO adopted an initial strategy to reduce annual greenhouse gas emissions from ships by at least 50 per cent by 2050 compared with 2008 – a particularly important development. With regard to air pollution, the global limit of 0.5 per cent on sulphur in fuel oil used on board ships will come into effect on 1 January 2020. To ensure consistent implementation of the global cap on sulphur, it will be important for shipowners and operators to continue to consider and adopt various strategies, including installing scrubbers and switching to liquefied natural gas and other low sulphur fuels.

In general, the scope of a greenhouse gas emissions-reduction scheme for shipping should cover various elements. For instance, should the scheme cover all greenhouse gas emissions or only carbon dioxide? Which vessel sizes and types should be considered? Should emissions from international sea transport be the only emissions included or should domestic shipping also be taken into account? Should the price be set per unit of fuel or per ton of carbon dioxide? In addition, a strong and reliable audit and enforcement system is required. Compliance could be checked by port State control by means of the bunker delivery note, the oil record book or the IMO data collection system.

Although projections tend to be positive, the issue of how global and local maritime transport demand will evolve over the next 30 years is subject to a high degree of uncertainty, driven by a wide range of prevalent downside risks and emerging trends that will bring challenges and opportunities for the maritime transport sector.

Shipowners and operators have various options to meet the IMO sulfur cap requirements. Vessel owners and operators will have to consider a wide-variety of factors when choosing their compliance solution including the vessel age, operating and capital costs, fuel availability, technology solution availability and reliability and the primary trading areas.

IMO2020 preparations and fleet inefficiencies due to fuel switching reduce active fleet supply and take the edge off deliveries in 2019-20. Slow steaming prevails in 2020-21

Risks

A rapid increase in demolition activity and rise in freight rates due to IMO2020 may lead to a change in sentiment and ordering may once again surge.

Although this would be for fleet-renewal purposes there is always a good chance of over-ordering, given the industry’s track record.

IMO 2020 preparations will have significant implications on active tonnage supply

2019 will also see the global commercial fleet switching from HFO to low-sulphur fuels. IMO2020 is probably the biggest regulatory change in shipping history and will have significant implications on active fleet supply.

Over 270 crude oil tankers are scheduled to retrofit scrubbers in 2019 and 1,600+ will have to clean fuel tanks~ in order to switch to compliant fuels. The active fleet is likely to expand much slower as a result.

After January 1, 2020, the world will not use the product with a maximum sulfur content of 0.5 percent, and the process of adapting ships to the rule by installing a highly costly scrubber will be the main agenda item for the next 12 months.

With less than 10 months remaining, the global shipping industry is setting aside about $60 billion to obtain the right infrastructure in order to embrace cleaner shipping fuel.

In the 1800s, access to raw materials for economic development was important. In the 1900s, access to energy and transportation came forward. In the 2000s, internet connection and intellectual capital gained importance. Now everyone can reach each other, so they can sell goods. Globalization has greatly increased the importance of logistics opportunities. Globalized markets, such as transport, storage, production and packaging, spreading all over the world, have increased the importance given to logistics.

Turkish bunkering industry preparing for IMO 2020

If we look at where we are in the shipbuilding sector, Turkey has become a brand, especially in certain type of boat. It has become a sought-after country in yachts, service ships, chemicals, tugboats. On the other hand, İstanbul bunker sector says it will be ready IMO2020.

Several Turkish bunkers players joined forces for the upcoming IMO2020. Such companies like Arkas, Socar, Petrol Ofisi came together to form the committee Bunker 2020. The purpose of the committee is to prepare the sector for 2020 IMO regulations.

Are you ready for #IMO2020 ?