What changes and new trends are waiting for us in the maritime industry in the first new year of a brand new decade?

Advances in technology, environmental concerns, commercial necessities, and many more factors will once again determine the direction the shipping industry will go. So, in the light of recent developments, let’s try to predict what awaits us in the industry in 2020.

IMO 2020: The most important variable in the equation

As of January 1, 2020, International Maritime Organization (IMO) member states will be expected to fully implement the new global marine fuel sulphur cap. To know more details about it, you can check our IMO 2020 article.

Even though this new regulation will help protect the environment if the implementation rate is high enough, it will have another important effect: The high-sulfur fuel oil will drop in price as demand decreases, but low-sulfur oil (diesel) will be in higher demand. So, its price will increase. Rising fuel costs should, of course, increase the freight rates.

Moreover, slower speeds will likely be chosen to decrease costs and emissions, but this will increase travel times. The longer travel times will limit the transport capacity of the ships, eventually reducing the profits.

A better balanced and more disciplined industry on its way

The capacity cuts have one other important effect: They contribute to the late trend of carriers controlling the supply better and influencing the market by creating a better supple-demand balance. Even though the smaller carriers are likely to remain vulnerable, these cuts will benefit them even if just a bit, providing another aspect of balance in the industry. They will have to be more disciplined to stay in the game though, since a decrease in the steamship lines will reduce service loops and make it harder to catch deadlines at origin countries, therefore require better discipline.

3 Technology Trends of 2020

The technological advances affect the future of the maritime industry, just like countless other industries. According to the Global Marine Technology Report 2030, the maritime technologies to look out in the nearest future are as follows:

Shipbuilding

Operational efficiency and environmental concerns will shape new shipbuilding technologies. For example, 90% of raw materials may be in traditional subtractive manufacturing methods. By contrast, the introduction of additive manufacturing deposits materials only where they are required.

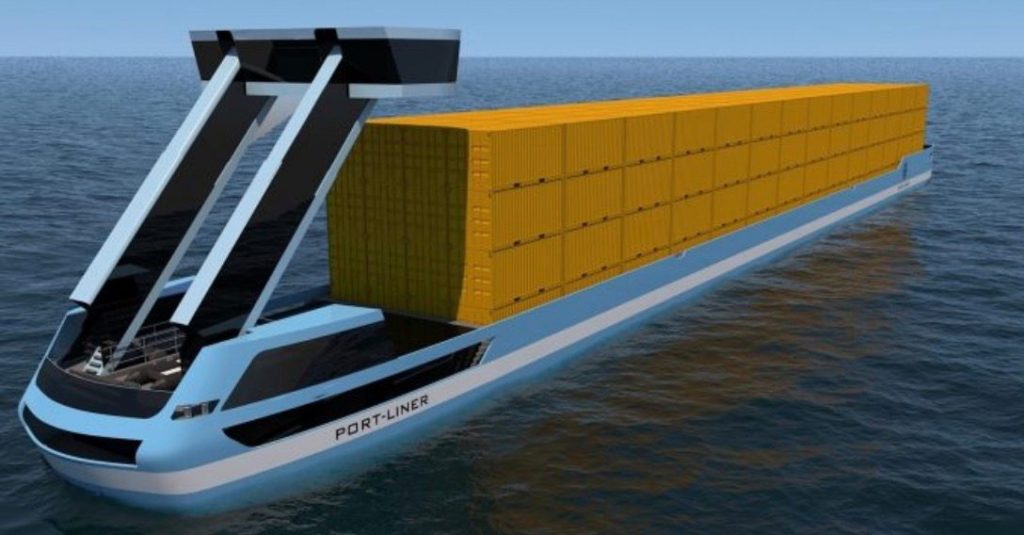

Smart Shipping

It’s estimated that 10% of the new buildings will be smart ships. The definition of the smart ship will continue to evolve as well. The smart shipping technology will include all the advances to improve operational efficiency, ship management, regulatory compliance, decision-making, environmental responsibilities, etc.

Big Data and Communications

The industry is likely to continue to invest in IT structure to be able to retrieve, store and process bigger chunks of data in real-time. The increasing volume of data will require more efficient data transfer. This will be acquired with the integration of 5G, WiFi and new generation satellites.

U.S. vs China: The War Continues

The trade war between the U.S. and China has already hit both economies. According to Morgan Stanley, the trade conflict could reduce 0.81 percentage points off the global gross domestic product, meaning the U.S. implementing 25% tariffs on all goods from both China and the E.U., just before getting a similar response. Even though the economy has been going relatively well lately and the 2020 forecasts are not big concerns, Donald Trump’s turbulent presidency is always something to take into consideration.

Southeast Asia will continue to grow

Since the second of 2018, there is a shift of shipments in the industry in favor of Southeast Asia countries, especially. 2020 will be the year we will start to see the real effects of many importers completing their setups from alternate countries. Even though these volume shifts don’t mean that China will lose its leading role, nothing could be further from the truth, new countries will continue to enter the game as attractive alternatives thanks to their better infrastructure investments.