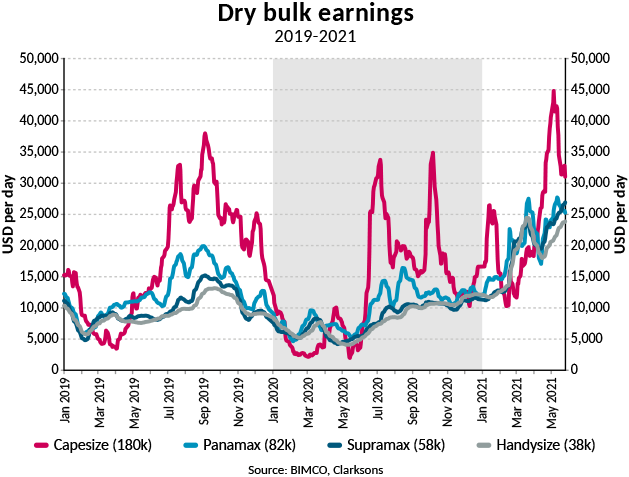

Dry bulk freight rates set a record with the increase in cargo loading volumes in 2021.

The dry bulk market includes iron ore, coal, grains, oilseeds, steel, cement, forest products, agricultural products, non-ferrous minerals and metals.

Prices driven by the commodity boom, high shipping demand, port congestion and the world economy recover from the pandemic.

According to Clarksons Platou Securities the dry bulk shipping industry recorded its best first-half performance in a decade. Rates exceeding US$30,000 per day for Capesize, Pannamex and Supramax vessels. – Freight Waves reported on June 28. Panamax ships are at US$32,800/day and Supramax vessels are at US$31,600/day. That’s more than 10 times the jump from the $3,000 figure in February last year.

The Baltic Dry Index tracks the proportion of ships carrying dry bulk goods. It increased by approximately 74% from the beginning of the year to July 3.

It’s rare for all three size categories to exceed the rates of $30,000 at the same time, according to the report. Freight Waves noted that Panamax and Supramax rates expected to hit new highs for the year. Rates are more than double the five-year averages of former rates. And more than three times the Supramax rates. Oilseeds are usually transported by Panamax vessels. They are capable of carrying 60,000-100,000 dwt.

According to analysts, there may be risks and global factors that will affect prices. And expects freight rates to remain high at least in the second half of 2021 and beyond. Now let’s look at these issues;

What drives prices up!

Several factors supported freight rates; The commodities boom, which boosted transport demand. The economic recovery as parts of the world rebounded from the pandemic.

Government policies and macroeconomics are at the center of “very strong” markets. Officials are pumping cash into the system through stimulus measures. And it’s a “fundamental leverage” to boost economic growth. Overloaded GDP growth drives demand for commodities, and it’s the basis of the strong markets.

James Marshall, CEO and founder of shipping company Berge Bulk mentioned that the greater iron ore supplies from Brazil and stronger coal demand from China in the second half of the year. This will be positive effect for freight rates.

Inefficiencies and port congestion can also contribute to increased shipping costs, Ships are still held because of Covid quarantines. If congestion is getting worse with the delta variant and more problems with Covid infections, It could lead to a significant contraction in the market in the second half of the year.

Risks

Government policies can easily stop costs from escalating further. If macroeconomic conditions remain strong in 2023, the world may be in a “dangerous position” for inflation, which will also affect the shipping cycle. Also, a recovering pandemic situation may soften price increases.

Once the Covid restrictions are eased, the congestion at the ports will be reduced and shipping capacity will be freed up. The capacity is back on the market, the price spikes currently seen will subside. Failure to order new ships and the phasing out of some older ships may also result in higher rates.

For the next 3 years, the fleet growth is estimated to be no more than 3%. Judging by the bulk carriers alone, the building capacity is also known to be insufficient. In this case, if there is a demand growth above the fleet growth, the freight market rates will continue to increase.