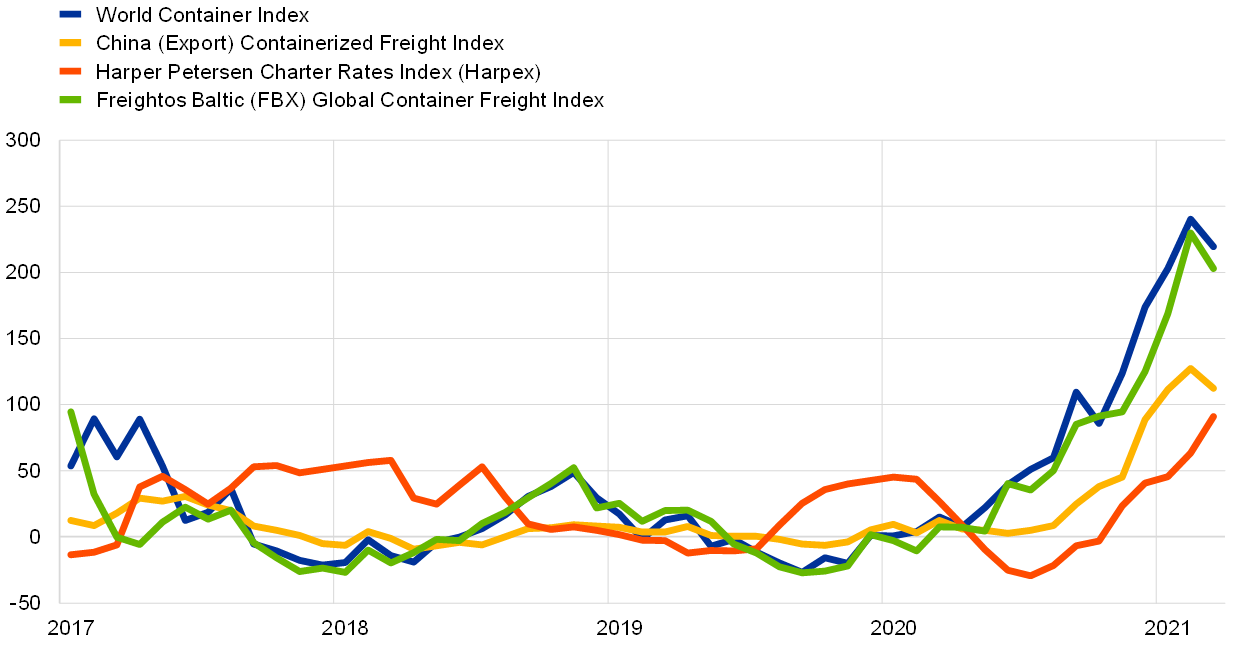

Container and dry bulk carrier earnings are at record levels as high demand for the goods hits supply chains.

Despite the Covid market conditions, the container market figures are very high. The increase in customer demand at the same rates enabled container manufacturers to make huge profits. Also carrier profitabilities increased because of the exceeded capacity. Financial performance in 2021 expected to be better than in 2020. A limited supply of new ships is entering the market, while consumer and industrial demand for the goods remains very strong.

Strong financial and operational performance expected to also cover the dry cargo and tanker sectors. This led to the decision to upgrade the maritime segment rating from stable to positive.

Global demand predicted by analysts to surpass container shipping capacity this year. It expects a volume increase of 5 to 7 percent against a 4% increase in capacity. The supply-demand imbalance has been in favor of carriers for months. According to Sea-Intelligence Maritime Analysis, operating profit of 11 reporting carriers measured. The earnings before interest and taxes reached $16.2 billion in the first quarter. It is more than the previous 10 first quarters combined.

Carriers increase their historical profit forecasts…

The container shipping industry would generate operating profits of $35 billion by 2021. But, this figure expected to increase due to continued high demand levels and a steady increase in contract rates.

Spot rates on the China-US West Coast were $4,553 per TEU, up 400 percent from the same period in 2019 before the pandemic. China-North Europe spot rates increased 636% compared with 2019. While spot rates Northern Europe-US East Coast were up 218% compared to the same period 2019.

Contract rates of 90 days and over on China-US West Coast routes increased by 92 percent compared to 2019. China-North Europe contract rates are up 117% to $1,614 per TEU. And Northern Europe-US East Coast contract rates 52 percent higher at $1,307 per TEU.

Despite record rate levels, demand is so strong and capacity is so limited. Carriers need shippers to pay large premiums to guarantee space, with charges that can go as high as $2,500 per container. As a result, importers pay very much. Most spot importers pay thousands of premiums above the market to make secure space.

Robert Khachatryan, COO of Freight Right Global Logistics, told that importers with annual contracts transport some containers at contract prices. But about 90 percent of their cargo transported at premium prices. The premium rates for bookings from Asia to the US East Coast are up to 10 times higher than in the same period last year.

The forecast for 2022 is that earnings will fall from their 2021 peak. But, it will remain high. Demand for goods will remain strong in 2022, but the growth rate is likely to decline. Yet, despite the expected recovery in oil demand, oil tanker charter rates remain “very low”. Capital expenditures in the broader shipping sector will continue to increase. The demand for new and more energy efficient vessels will increase. They will prepare for harsher environmental standards from 2023. Meanwhile, strong demand for iron ore, coal and grain will push up rental rates. Moody’s said that average charter rates for dry cargo vessels have increased by approximately 143% over the past 12 months.

The current record levels in the container market have two effects on the dry bulk industry. First, and more important for the current situation, is the expansion of the container market. Trades, which are generally transported by containers, have started to transported by dry bulk ships. The reason is the significant difference in freight rates. This situation caused fluctuations in demand and freight rates in dry cargo.

Second, the total new generation capacity limited. Currently, shipowners fill their short-term delivery quotas with containers. In this case, dry bulk market earnings per unit will be higher, as future supply will be even more constrained. Demand and supply fundamentals could further improve and fleet use could continue to get better.

Related Articles

What-will-happen-in-the-container-market-after-the-coronavirus-outbreak/